What Are the Different Types of Liens in Real Estate?

A lien is a legal claim that gives the lienholder the right to seize the property if the debt attached to the lien is not paid. Understanding the different types of liens is crucial.

A lien is a claim made against a property by a creditor to secure payment of a debt. When a homeowner neglects to settle a real estate tax bill, the local government may impose a lien and generate a tax certificate, an enforceable first lien against the property. So, how do liens work? In this article, we'll explore the different types of liens and their significance in real estate to help you better protect your investment and avoid legal disputes. Read on to learn about different liens types.

What is a Lien?

In case you're been googling "What is a lien in real estate," or "Lien definition in real estate," we've got you covered. At a glance, liens are typically used to collect payment for services rendered, such as repairs to the property or as a result of a court judgment. If the debt is not paid, the lienholder has the right to seize the real estate property.

Categories of Liens

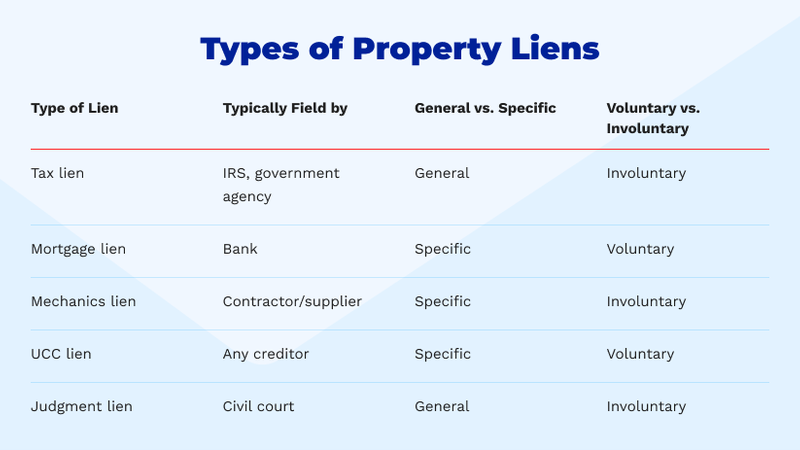

When it comes to categories of liens, there are generally four basic types, usually compared as voluntary vs. involuntary and general vs. specific lien. Continue reading as we discover each category in detail, followed by voluntary, involuntary, general, and specific lien definition.

General Liens vs. Specific Liens

What is a General Lien

A general lien is a category of property liens that covers all of a person's own property, not just a specific item or item. This means the lienholder has the right to seize any property owned by the debtor to satisfy the debt. Examples of general liens include judgments against a person in a court of law and tax liens imposed by the government.

What is a Specific Lien

A specific lien is a lien placed against a particular piece of property, such as a car or a house. For example, if a mechanic repairs a car and the owner doesn't pay for the services on time, the mechanic has the right to place a specific lien on the vehicle until the debt is paid. Once the debt is satisfied, the lien must be removed from the property.

Voluntary vs. Involuntary Lien

What is a Voluntary Lien

A voluntary lien is a category of property liens created by the real estate property owner or borrower. Generally, the types of voluntary liens are often used to secure a loan to purchase a real estate property or to obtain financing for improvements to a property. Examples of voluntary liens include house mortgages and home equity loans.

What is an Involuntary Lien

An involuntary lien is imposed on a property without the owner's consent. Generally, the types of involuntary liens can result from a legal judgment against the property owner, a failure to pay taxes, or a mechanic's lien being filed for unpaid work on the property, which significantly impacts a property's overall value in the market.

Liens in Real Estate: Understanding the Different Types of Liens on Property

If you're wondering what are the different types of liens, here’s what you need to know: When owning property, it's essential to understand the lien types that may be placed against it. The following are the main types of liens on the property:

- Tax Lien: A tax lien is a claim made by the government on a real estate property when the owner fails to pay their property taxes. It must be satisfied before other debts can be paid.

- Mortgage Lien: A mortgage lien is a type of voluntary lien created when the owner borrows money for a property or improvement. The lender holds the lien until the loan is paid in full.

- Mechanics Lien: A mechanics lien is a specific lien imposed on a property by a contractor or service provider when payment for work performed on the property is not received.

- UCC Lien: A Uniform Commercial Code (UCC) lien is a type of lien placed on personal estate properties, such as equipment or inventory, used as collateral (guarantee) for a loan.

- Judgment Lien: A judgment lien is a lien imposed by a court of law due to a legal judgment against the owner. It is a claim made on the property in order to secure payment of a debt.

Besides these common types of liens in Texas, we'll also cover statutory liens.

What is a statutory lien? It is a legal claim that a creditor has on a debtor’s property. This type of lien is created when the debt is incurred and is usually enforceable in a court of law. The purpose of a statutory lien is to secure payment for a debt that is owed. It is typically used when the debtor does not have assets to voluntarily pay off the debt, or when the debtor’s assets are not sufficient to cover the debt. In some cases, the lien may remain attached to the property even after it has been sold or transferred.

How Do I Find Out If There is a Lien on My House?

Here are a few things you can do:

- Ask Your Title Company: Your title company can perform a title search to see if there are any liens on your property.

- Go to Your County Courthouse or Recorder: You can visit your local county courthouse or recorder's office to conduct a search for available liens on your real estate property.

- Look Up Your Property Online: You can also perform an online search through the county recorder or clerk's website to see if there are any liens on your property. Note that this information is typically public and easily accessible online in a matter of just a few seconds.

How to Remove a Lien

The answer to “How to remove a lien” can be complex since it’s a time-consuming process. If you have a lien on your property, the best strategy is to remove it as soon as possible to avoid any negative impact on your credit score or property value. Some general steps to remove a lien include paying off the debt, challenging the lien's validity, or filing a document of motion to release the lien.

Note that if you want to remove tax lien from your property, you may need to pay the outstanding property taxes or negotiate a payment plan with the government of the country you reside in.

Fill out the contact us form today and allow our experienced team to follow up with you.